APIR Code: ARG3633AU

Platforms: Hub24, Mason Stevens, Powerwrap, Netwealth, Australian Fund Monitors

Inception Date: 21 Jan 2020

Type of Fund: Wholesale Trust

Mandate: ASX & international mining & resource companies

Benchmark: S&P ASX 300 RES

Style: High Conviction

Portfolio Stocks: 10-25

Max. Cash: 30%

Min Initial Invest.: $50,000

Man. Fee: 1%

Perf. Fee: 20% of returns in excess of the benchmark, subject to a high-water mark

Fund Pricing: Monthly

Distributions: Annually

Reporting: Monthly

Fund Overview

Unit Price: $2.116

The Argonaut Natural Resources Fund is a high conviction investor in the Australian resources market. The portfolio holds between 10 and 25 stocks with individual weightings typically between 4% and 12%. Cash weighting will be adjusted depending on the assessment of market risk with a maximum exposure of 30%.

The investment manager adopts a three step investment process which includes an evaluation of market conditions (MARKET), an assessment of the macro environment and geopolitical conditions (MACRO) and an assessment of specific companies based on our 5 Bricks evaluation process which analyses companies according to valuation, management strength, business strength, financial strength and responsible investing (MICRO).

More specifically, we blend a “top down” approach to identify favoured commodities with a “bottom up” approach to select good quality / good value companies exposed to favoured commodities. A favoured commodity may be one that is in favour now, such as Gold, or a commodity that is out of favour and represents a compelling countercyclical opportunity – such as battery metals.

We seek to allocate approximately 40%-60% of the portfolio to key long term themes with the remainder of the capital allocated more opportunistically. We are patient investors and adopt a three year investment horizon. We recognise that high conviction investment may lead to periods of underperformance but believe that over the long term we will outperform passive resource sector investing and our benchmark index.

Performance History

**All ANRF performance figures are net of fees. Past performance is not indicative of future results.

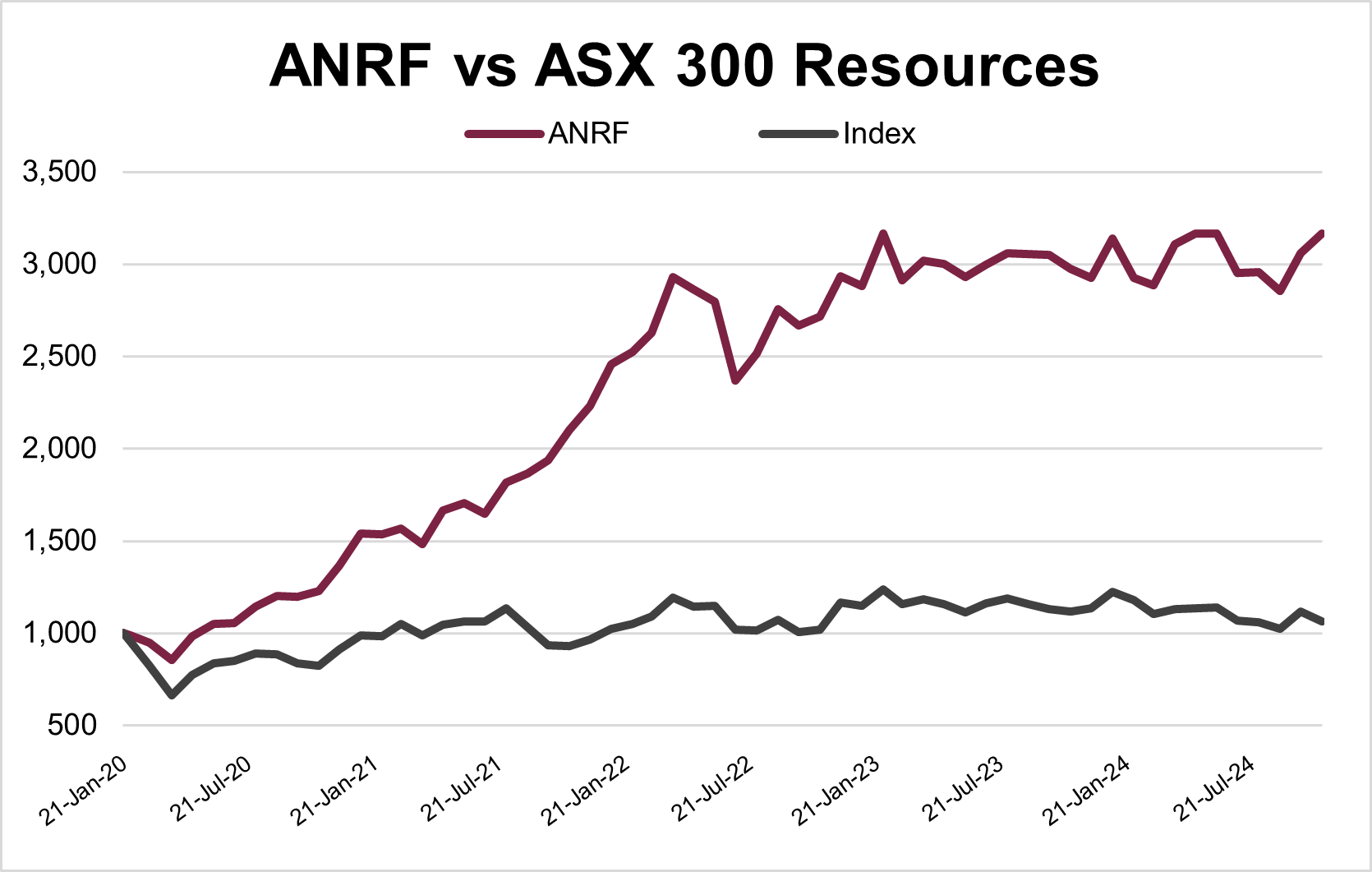

Illustrates the relative performance of a $1000 investment in ANRF, net of fees, and the ASX 300 Resources Index since the inception of the Fund (21st January).

Assumes all distributions are reinvested back into the Fund.